Clear Decisions

Reaching 64 years old gives access to some of the greatest years of living. The first 20 years is about growing and learning life. The next 20 gives us an opportunity to lay a foundation. The third 20 years develops our friendships and family and sets a course. We discover more of what really makes us tick. The next 20 to 40 years is an adventure like none other. Get a better life forward.

The recent book When I’m 64: 7 Clear Decisions for a Better Life Forward by Phil Larson, the think doctor, is an amazing entry into this life span opportunity. The population of the United States becomes increasingly larger and larger a proportion of those over 65 to those under. It is an exciting time in which to live. The dynamics of culture and economies will shift to meet these wonderful times.

You are one of these leading the charge into a better life. How will you do it? What decisions will you make to increase your life enjoyment? Happiness is a decision you control. Control it. Get the information you need and make good decisions.

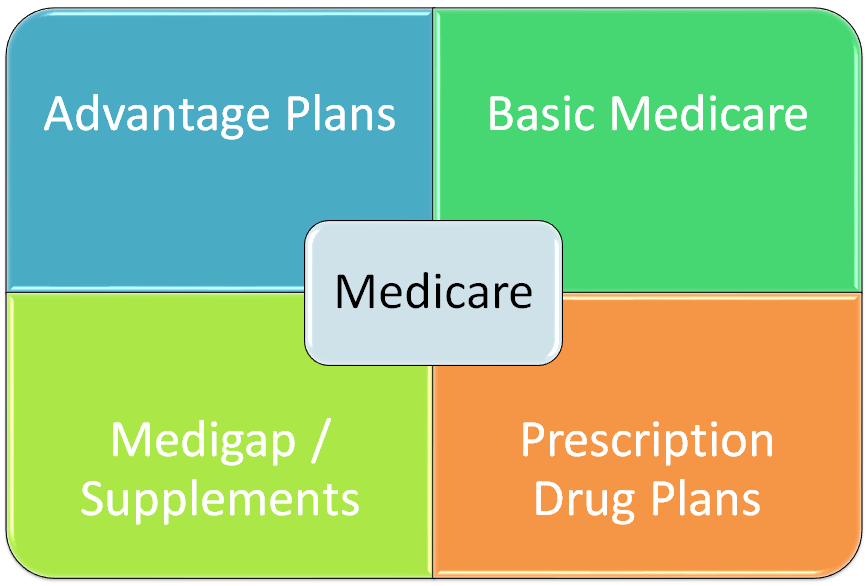

One of the clearest decisions is your healthcare provision under Medicare. You can decide for an Advantage Plan or a Supplement Plan to come alongside your Medicare A and B. Medicare A takes care of Inpatient care in hospitals, skilled nursing facility care (not custodial), hospice care, and home health care. Medicare B covers outpatient care which include services from doctors and other health care providers and some preventative services.

Why pick an Advantage plan? Advantage plans from a private insurance carrier usually provide an HMO or PPO plan with a local network of providers. They can have extra benefits and may include a prescription drug coverage all with a low or zero extra premium. Take the time to get fully acquainted by using a licensed and trained agent like SOLUM provides or any of our partners across the United States with the GrandParentBenefits.org affiliation. When you have limited funds, an Advantage plan can give you some cost reductions and management. You can get a plan that includes prescription drug coverage.

Why pick a Supplement or Medigap plan? Average costs for medical run between $4000 and $5000 a year with deductibles and payment sharing. A supplement can pay the majority of these for a predictable and managed premium. You control your costs at a premium that may be closer to $2000 a year, when you include prescription drug coverage. That can represent significant cost savings over your senior years.

Go to our website and read more. Advantage / Supplement

You matter. Your choices matter. #wecanhelpwiththat

A Better Life Forward

What does that mean? You might have a great life now. Why not have it better? You might have some struggles and interruptions that attempt to rob your joy. Why not have it better? Whatever condition you find yourself in life, there is opportunity for a better life forward. And, I want to help you have it. When you turn 64, there are some important decisions to make about your Medicare. You have structured time frames in which to make them and want to get them done early, but with informed and clear decision. Our team is always posting information on decisions surrounding Medicare on

- Linkedin https://www.linkedin.com/company/solum-insurance/

- Facebook https://www.facebook.com/medsolum/

- Website https://soluminsurance.com

- BLOG: https://soluminsurance.com/blog

Want the entire EBOOK? When I’m 64: 7 Clear Decisions for A Better Life Forward. Send me an email at phil@soluminsurance.com and I’ll reply with a copy of the book that is print ready for your home or office printer or can be read easily online with large type. Want a printed out copy? Send me your address with that email and I’ll ship one right out to you.

Phil

405.494.0637 – office cell/text