What is character and how does it work for you?

Everyone has a different definition of character traits that contribute to success, but one of those that overshadows most came to me from Earl Nightinggale. “Success is the progressive realization of a worthy goal.” Let me explain what that has to do with character.

Take it apart and here are the character traits.

Success Orientation

Progressive

Realized Results

Worthy Goals

Those four character traits will get you far in life. They may not look like what you were expecting. You might have been expecting a note on the virtues of a positive human or a Christian or a community contributor or a business professional. These four apply to all of that and more.

Success Orientation: Some people have no desire to compete or win in life. If you do not value success, you will not have success. Your life will be plagued with losses and disapointments. Get a character that wants to win. You want to win and you want others to win. Zig Ziglar says, “You can have everything you want in life if you help enough other people get what they want.” That is a success orientation. You are committed to have enough to satisfy your lifestyle and sufficient to give to others in need. You are committed to the success of every other person with whom you come in contact. You are generous and gracious and competitive with yourself. Have a success orientation.

Progressive: Success, accomplishment, overcoming shortcomings, and getting to the top of your vision is progressive. Develop a progressive attitude. Quit looking for easy wins and low hanging fruit. That stuff is for those committed to losing or making others lose. You may gain finances. But finance is only a part of success character. Arriving at a worthy goal means arriving with a clean and pure conscience. You don’t have to look behind to find who is following. You see progress every day toward the goal. One day may be a big jump. Another day may be a small step. Every day moves you closer to the goal.

A few good men served today ( Nov 28, 2016) at Ohio State University. During a campus attack from a madman, they responded with character, competence, compassion, and chemistry. How rare do we see these three in action? In our age of self-service and self-serving, we are missing large quantities of courage, discipline, orderliness, compassion, reliability, accountability, selfless giving, and selfless service. Journalists attribute their response to military preparation. Maybe, but I bet there were other military trained on campus and maybe even in the room. These men had something more.

These men stood to the moment. When word went out, they organized their class of students away from the door. Then they placed themselves in harms’ way at the entrance to the room. Had the attacker walked into that room, he probably would not walk out. They showed character, competence, compassion, and chemistry under pressure. Under pressure we are our better selves and we are our worst selves. We choose each time.

Yesterday, a man came to me in my office and asked me an odd question. “What is prudent?” He was looking for a dictionary definition. A quick anger assessment that we do had thrown an unfamiliar word at him. Arms crossed, face scowling, hard life screaming from his face, he looked for an answer. For a moment, it was hard to answer. The temporary confusion was not because I was stumped for a definition. It has hard to answer because it means so much. To summarize, a prudent person does the right thing at the right time with the right wisdom backing the choices. A prudent person would not be standing in my doorway taking an anger assessment because he was on probation, community supervision, supervised by the state.

A little later I was on the phone with a case manager overseeing a family situation. Seems the man and woman showed up for a court hearing on neglecting their children while they were high on drugs. Bad had gone to worse. Maybe they are good hearted and imprudent. Nevertherless, they chose to put their children in danger and now the children are under conservatorship in foster care and the parents are being supervised by the state.

The men in the first story sound like my children. I would place my life in the hands of any of my daughters, sons, and their spouses. I trust their decisions over their homes and families and neighbors. They do not believe the way I believe on every subject. They do follow prudence. They do exhibit wisdom in right choices over and over and over. They do exhibit the 4 Cs of Success multiplied by lives lived for Christ.They don’t need me, my wife, or the state to supervise them. They have been raised.

The men in the first story sound like key employees I have had over time. When they show me the balance of character, competence, chemisty, and compassion, I invest trust and training and increasing responsibility and watch them grow. Consistency and congruency takes over and multiplies their contribution. Talking to my assistant yesterday, I told the story of one such colleague. When this person came to work for me, she could not show up regularly and her work results were erratic. But underneath her chaos, I saw the 4 Cs of success. Over the years, we walked through developing good work habits, learning good work skills, and living through deaths and distractions that life throws us. Her contribution increased as the 4 Cs ordered her life and her income and influence quadrupled. Income in life is directly proportional to contribution.

How does it work? The 4 Cs of Success produce a consistent and congruent contribution. Here is the formula (Character + Competence + Compassion + Chemisty) x (Consistency + Congruency) = Contribution3 . This missive is already too long, so you must read the next few to get the full story.

Note: SOLUM Community Transformation Initiative is a 501c3 dedicated to fixing fractured families. We work with strugglers to stabilize and unify homes. Make your financial contribution today to turn the corner in character for men and women and their children. http://solumcommunity.net/

Check out the definitions of prudent. Synonyms and Antonyms of prudent (merriam-webster online dictionary) http://www.merriam-webster.com/thesaurus/prudent

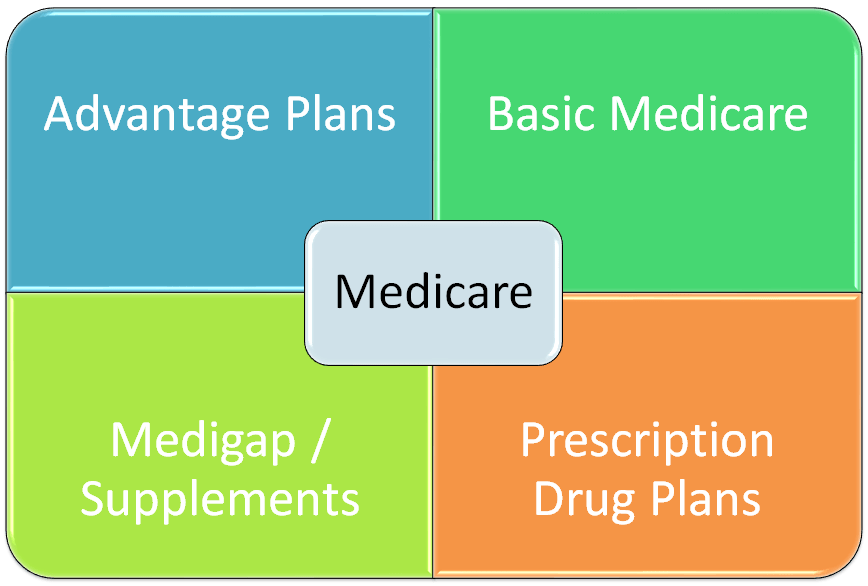

Thanks to Boomer Benefits for this super clear graphic.

Thanks to Boomer Benefits for this super clear graphic.

Reality is the average life expectancy is 78.something and declining for the first time in decades. I am not ready to concede defeat yet. Hit the gym this morning for a solid workout. Adjusting my eating to offset risks of Alzheimers and keep my brain running at optimum. Brain envy is what Dr. Daniel Amen calls it. Resting more as I age, only working 50 hours a week instead of 60-80. What are you doing to shift? As a life coach, I have to set the example. #wecanhelpwiththat

Reality is the average life expectancy is 78.something and declining for the first time in decades. I am not ready to concede defeat yet. Hit the gym this morning for a solid workout. Adjusting my eating to offset risks of Alzheimers and keep my brain running at optimum. Brain envy is what Dr. Daniel Amen calls it. Resting more as I age, only working 50 hours a week instead of 60-80. What are you doing to shift? As a life coach, I have to set the example. #wecanhelpwiththat